Gulf Oil to Be Acquired by Private Equity Roll-Up

Gulf Oil has been sold.

The buyer is ArcLight Capital Partners, which prior to this spring was a little-

known but especially well-heeled Boston-based private equity firm with over $12

billion in investments. ArcLight burst onto the scene in February when it outbid

Marathon Petroleum and several other publicly traded master limited partnerships

and acquired Petroleum Products Corp. (OPIS 2/18/2015).

ArcLight is not to be confused with New York-based Arc Logistics LP, a public

company that operates crude and products terminals in various Great Lakes and

Southeastern states as well as in New York Harbor, Louisiana and Mississippi.

The two companies have no affiliation.

ArcLight has been active in downstream petroleum before, however. The company at

one point held a stake in the General Partner share of Buckeye, and helped

launch public MLPs in natural gas, crude oil, shale and asphalt.

The deal was announced to employees at Gulf's Framingham, Mass., headquarters

this morning and has been in the works since October. The company's assets

elicited very strong interest from refiners, private and public companies, and

especially within the segment of master limited partnerships, which need to grow

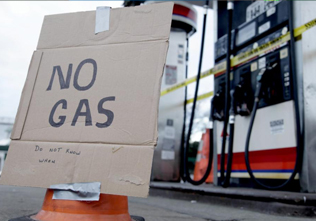

in order to sustain their business models. Sources say that the Sunoco LP, and

its affiliate Energy Transfer Partners, was among the finalists and ambitious

bids were also received from Marathon, Global, Noble and others.

ArcLight will purchase the assets from the Haseotes family, which will in turn

concentrate on expanding its Cumberland Farms' offering in the Northeast and

elsewhere. The family had considered a sale or other options for the Gulf

assets some seven years ago, but pulled the offering from the market when the

economy slipped into recession. The ongoing sales process was managed by

investment bank Evercore Partners.

ArcLight's first goal may be to figure out a plan to integrate the Gulf assets

with the terminals it acquired from Petroleum Products (PPC) in April. Gulf has

seven terminals in Pennsylvania, and when the PPC properties are added to the

holdings, ArcLight will operate 19 supply facilities in the state.

New to ArcLight will be the branded business, which includes a network of over

2,500 sites in 30 states with hundreds of dealers and distributors. Gulf also

owns a transportation fleet of nearly 200 trucks and has a significant network

of unbranded fuel sales through proprietary and third-party terminals. Gulf

also has a trading and blending operation and holds valuable legacy line space

on Colonial Pipeline.

So far, there is no word on what price might have been paid for the Gulf Oil

assets. ArcLight never disclosed the purchase price for PPC, but estimates put

the value at above $1 billion. Sources believe that the final price for Gulf

may have been in the $1.1-billion-to-$1.3-billion range or higher.

Source: Oil Price Information Service