The volatility that hurricanes Harvey and Irma brought earlier this Fall have stayed around as we head into Winter. The hurricanes initially caused fuel prices to surge, and after the initial price surge wore off in September and early October gasoline prices looked like they may continue to drift lower which lines up with seasonal weakness during this time frame.

However, refinery outages in Houston/Gulf area continue to affect the physical markets and regional supplies in the Great Lakes region became tight. Energy markets started to take into account the tighter supplied markets causing gasoline prices to increase for 5 straight weeks into the beginning of November.

Significant demand for fuel and tight gasoline supplies is not something often seen for this time of year. Demand for petroleum products in the U.S. have been strong and product exports are near record highs for this time of year. As imports into the U.S. East Coast drop, total U.S. gasoline and distillate inventories are falling despite a record year of refinery runs so far in 2017.

As of November 15 gasoline futures are almost 30-cents higher than they were back in August, and prices have backed off their early November highs. This surge in fuel prices has put strain on c-store gasoline profit margins at the pump. Average rack-to-retail c-store profits on gasoline gallons sold are the lowest in 10 weeks and diesel fuel profit margins reached the lowest in 3 months in the beginning of November. Pump margins are as tight in some places as they were when bulk prices spiked during the hurricane induced supply interruptions.

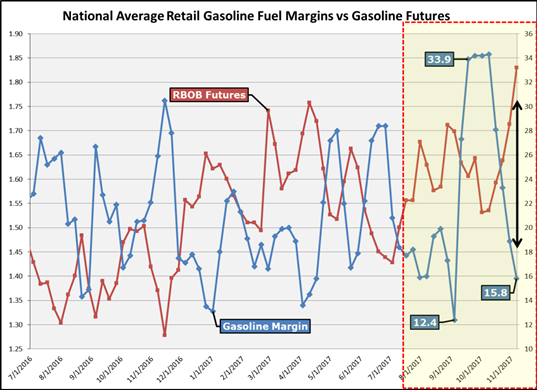

Since the first of October retail gasoline profit margins have been cut in half. During the week of November 3 nationwide gross gasoline margins (blue line on first chart) dropped to 15.8 cents/gal. As you can see on the far right side of the chart, retail gasoline margins hovered around 34-cents on average during the month of September. The month of September helped many c-stores recover some lost margin for earlier in the year.

However, those higher profit margins in September could not hold as gasoline RBOB futures (red line) continued to move higher reaching prices not seen in over two years. On a national average retail gasoline margins have swung over 20-cents twice over the last two months alone. This is due to the hurricanes margins being down to 12.4-cents at the beginning of Sept, and then surged higher to 34-cents where it stayed for four weeks. Once the futures market started to acknowledge the tighter supplies, margins tumbled almost 20-cents.

These numbers are slightly delayed and give you a macro view of how an average c-store’s fuel margin has moved this year. In just four weeks RBOB futures pushed more than 25-cents higher. These kinds of price swings and volatility can either make or break a c-stores month. Typically c-stores see better profit margins on their fuel sales when gasoline futures move lower or move sideways. Profit margins typically worsen when fuel prices move higher. The first chart illustrates this inverse relationship between c-store retail margins and RBOB gasoline futures.

To help protect themselves from these major swings in prices and profit margins, many c-stores implement a variety of hedging programs to help potentially improve profit margins on fuel sales. Traditional hedging strategies are still very popular and should remain in everyone’s hedging portfolio, however c-stores should also look at other alternative hedging solutions such as Automated Hedge Trading programs. An automated hedge trading strategy has the advantage of following a regimented and disciplined rule set that requires a more objective and reliable approach to trading. The computer can make all the buying and selling decisions for you.

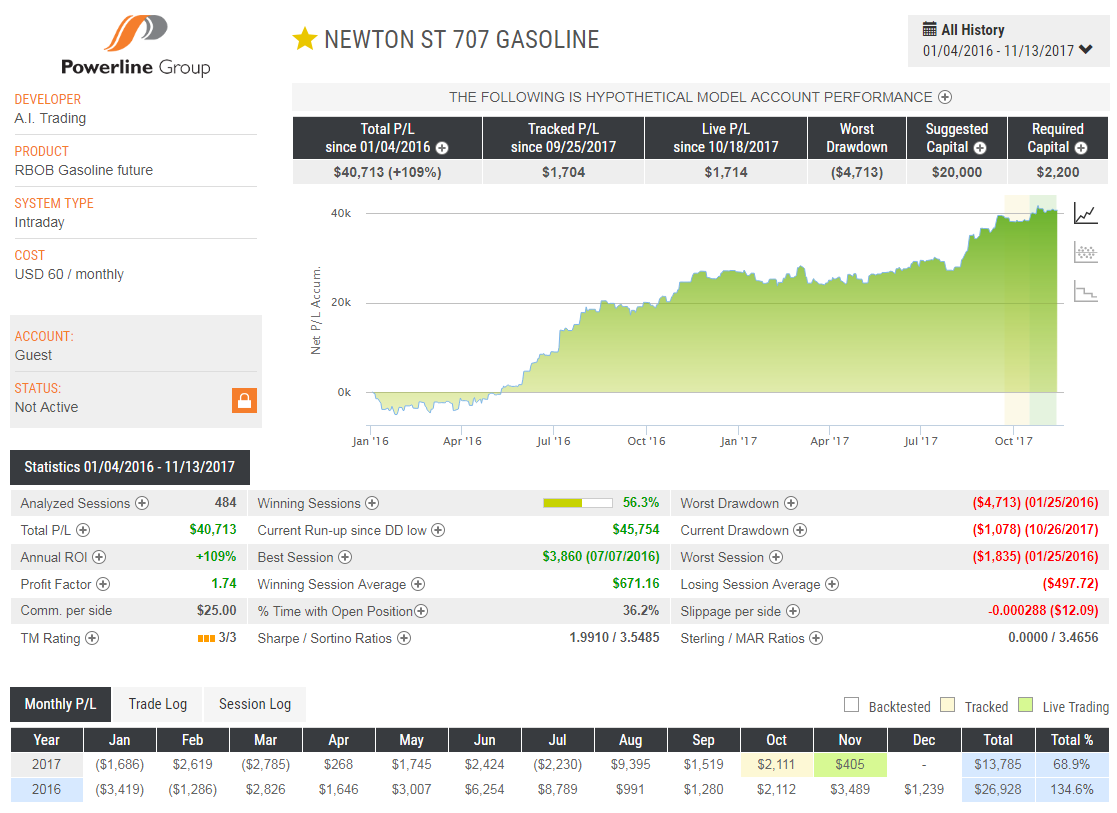

Below is the hypothetical performance history of an automated hedge trading program that Powerline Group is offering for RBOB Gasoline futures. This particular hedge program is designed to hedge with the intraday changes in the market, does not hold any overnight risk because it only trades during the day, and it has a live track record over the past two months. During the first two months of trade it has a Live P/L of $1,714, which is about 4.6 cents/gallon. The worst drawdown since the program started trading has been 3.7-cents, meaning at one point the trading program accumulated 3.7-cents in losses at some point. The months in yellow are tracked months, green months are live traded and the rest in white are hypothetical back-tested results. Based on hypothetical results the average monthly return for the past year has been approximately 3-cents/gal. All of the numbers in the image are based off of trading 1 contract equal to 42,000 gallons.

Powerline works with c-store operators and other petroleum marketers to develop approaches to enhance margins, manage inventory, ensure procurement budgets, and limit exposure to upside price risk in today’s extremely volatile marketplace. You can view the rest of our automated hedge programs at www.powerlinegroup.net.

Powerline will be adding more hedging trading programs over the next couple of months and will eventually have a portfolio builder that will give us extra tools to allow us to continue being a more efficient hedger.

Source - FuelMarketerNews.com